Private Stock Deals is a bulletin board service for helping the buyers and sellers of stock in private companies locate each other. It is not an online exchange for completing transactions. We do not charge or receive any fees regarding the use of the website or advise or participate in negotiations between parties. The website will keep your email address anonymous while you screen inquiries. If you want to take your conversation outside of this website, you merely have to reply to an inquiry with your contact information revealed in the body of your note. If privacy is an important issue to you, be sure to delete any automatically inserted signature blocks from your email. If you are replying to a posting, your email header will also be anonymized when communicating with the party that posted the listing. However, you should still take precautions to not reveal your identity through the content of your note including your email signature. We encourage both parties to obtain Non-Disclosure Agreements before sharing sensitive information.

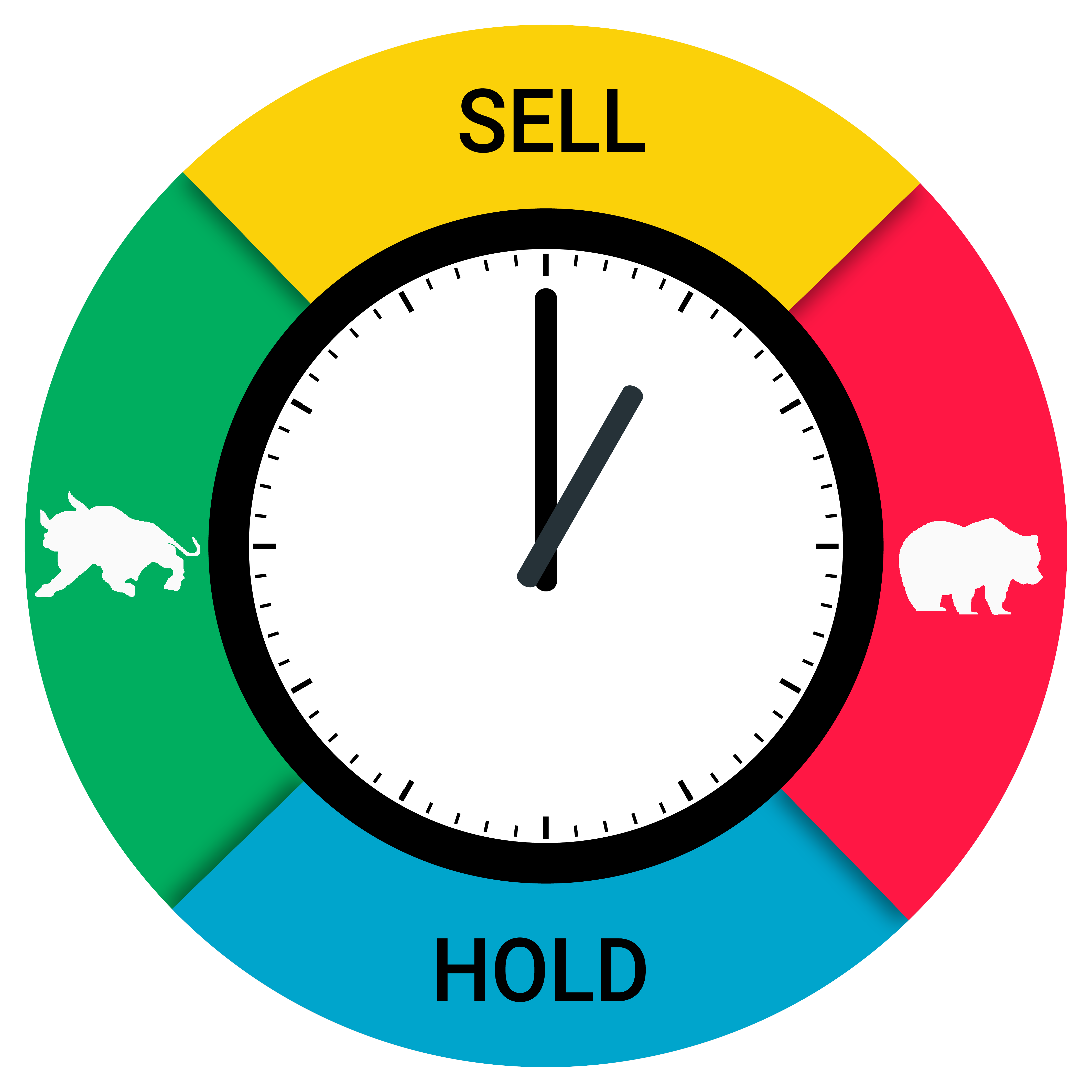

The clock you see at the right is a proxy for the state of the market for the stock of venture capital backed companies. 12 o’clock is viewed as the high point in the market while 6 o’clock is the low point of the market. 9 o’clock is viewed as the middle of a bull (rising) market while 3 o’clock is the middle of a bear (falling) market. These are macroeconomic cycles where a full 12 hours equates to an average of 3 years historically. However, some cycles have been less than a year and others as long as 15 years, so there are no guarantees that current conditions will last any particular amount of time.

Download our iOS or Android apps to maintain daily visibility on the current state of the market.

Our market clock currently shows 11 o’clock which means that the venture capital industry is in an upswing and near the top of the market. The number of venture capital backed companies in the IPO queue for 2015 is a substantial increase over 2014. When the IPO market is strong, then the M&A market tends to be strong as well as companies with cheap public currency will rush out to make strategic acquisitions while they can still afford it. Other indicators of the state are the 41 venture capital backed companies that have private valuations exceeding $1 billion at the time of this writing.

The mezzanine and secondary capital institutions that fueled these valuations are not long term investors and did so because they view IPO liquidity at even higher valuations to be imminent.

For questions and supprot, please contact us at support@statupstockdeals.com

If you are a broker or other related service provider and would like to advertise on this website, please contact us at sales@startupstockdeals.com

Over-posting or repeatedly top-posting of the same listing is prohibited and will subject your email address to being blocked from further posting. For additional rules and regulations, please review our User Agreement and Privacy Policy.